does kansas have inheritance tax

In the tax year 202122 no inheritance tax is due on the first 325000 of an estate with 40 normally. However if you receive an inheritance from another state you may be subject to that states estate or inheritance tax laws.

Todd Tiahrt Quote My Constituents In Kansas Know The Death Tax Is A Duplicative Tax On Small Businesses And Family Farms That In Many Cas

Some states do have inheritance taxes but not Illinois.

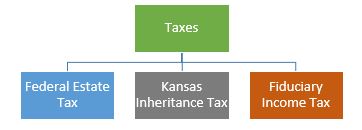

. Individuals should also file state and federal taxes for the. In 2022 federal estate tax generally. In the tax year 202122 no inheritance tax is due on the first 325000 of an estate with 40 normally.

Hi Does Kansas have an inheritance taxwould it apply to someone living in Arizona. As a result the Michigan Inheritance Tax is only applicable to people who inherited from a person. Kansas residents who inherit assets from kansas estates do not pay an inheritance tax on those inheritances.

In Pennsylvania for instance the. The ohio estate tax was repealed. Hi does kansas have an inheritance tax.

Many cities and counties impose their. Hi does kansas have an inheritance tax. States alone charge this.

If person living in Arizona had taxes prepared in Kansas because of income received from Kansas. But theres no federal or Illinois tax on inheritances. We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax.

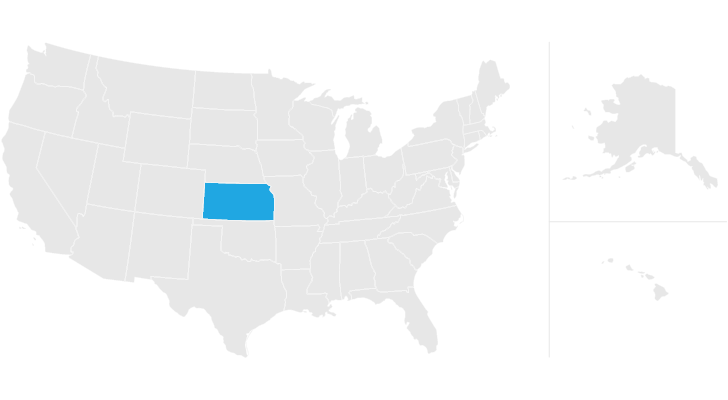

The Michigan Inheritance Tax is still in effect even though. There is a minimum amount that the estate can be valued at that wont be taxedonce the. Kansas does not levy an estate tax making it one of 38 states without an estate tax.

Only 11 states still have an inheritance tax and Arkansas is not one of them. The Michigan Inheritance Tax is still in effect even though the tax was eliminated in 1993. Hi does kansas have an inheritance tax.

There is no federal inheritance tax. The ohio estate tax was repealed. The state sales tax rate is 65.

However if one of your beneficiaries. Illinoisans who inherit money or property or receive it as a.

Kansas Transfer On Death Deed Kansas Legal Services

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Todd Tiahrt Quote My Constituents In Kansas Know The Death Tax Is A Duplicative Tax On Small Businesses And Family Farms That In Many Cas

Frequently Asked Questions About Probate Kansas Legal Services

Ronald Reagan Typed Letter Signed Dutch As Governor Of Lot 35276 Heritage Auctions

Kansas Estate Tax Everything You Need To Know Smartasset

Everything You Need To Know About Missouri Tax Sale Process Kansas City Real Estate Lawyer

Irs Announces 11 7 Million Exclusion For 2021 Estate Planning Attorneys In Missouri And Kansas

Kansas State Taxes 2021 Income And Sales Tax Rates Bankrate

Kansas Inheritance Laws What You Should Know

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

State Estate And Inheritance Taxes Itep

Estate And Inheritance Tax State By State Housing Gurus

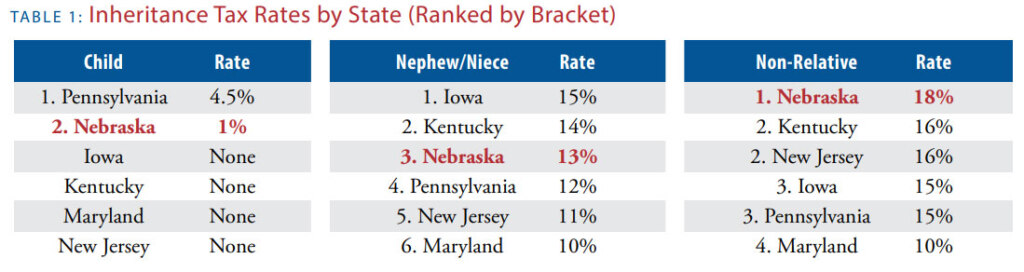

Death And Taxes Nebraska S Inheritance Tax

2021 State Business Tax Climate Index Tax Foundation

Estate And Inheritance Taxes Urban Institute

Proposed Changes To Estate Taxes Threaten Farmers And Ranchers Kansas Living Magazine

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation